Got Mail?

Just yesterday, my husband and I were discussing medium risk business ventures likely to be most profitable in the sub-continent. My husband, quoting the ills of the Indian postal system which is not only one of the largest networks in the world, but also one of the most inefficient, fervently supported the idea of turning franchisee for one of the private-sector couriers such as FedEx Corp. or United Parcel Service Inc. And it seems people have fast caught on to this idea. Today, private-sector couriers such as FedEx Corp. and United Parcel Service Inc. have grabbed more than half the delivery business nationwide in India.

And the inefficiency of India Post only helps. To illustrate, the average employee in the U.S. Postal Service handles more than 15 times as many pieces of mail a year as the average Indian postal worker. Further, the U.S. postal service is profitable, reporting an operating profit of more than $1.5 billion last year, while India Post lost $300 million.

What is of note is that India Post is not alone. An article in today's Wall Street Journal, "Snail Mail: As Economy Zooms, India's Postmen Struggle to Adapt - Beaten by Private Couriers, And Unable to Downsize, State Tries to Diversify - Selling Cashews and Aloe Vera," notes:

State-owned phone company Mahanagar Telephone Nigam Ltd. used to have a monopoly on much of the phone service in India. Today it is battling with an onslaught of internationally financed competitors that have driven the quality of service up and rates down on everything from local to long-distance to cellular service to Internet connections. State-run airlines Air India and Indian Airlines have been under attack for more than a decade and the industry has just become more competitive with six new carriers starting operations in the past two years. The banking sector is still dominated by the giant State Bank of India but the country's growing middle class is taking most of its business to the high-tech private banks, such as HDFC Bank Ltd. and ICICI Bank Ltd. leaving the state banks with the least-profitable businesses and worst borrowers.

And these are important constraints in India's growth maximization problem. Even as outsourcing dollars help to change the face of the Indian economy and its consumers, such change is moderated by political realities, chief among which is a succession of unstable coalition governments that oppose layoffs and privatizations. For example, when the current Congress led coalition first came to power in 2004, one of the first things it did was close the Disinvestment Ministry which oversaw privatizations. Contrast this to the closing down of unprofitable organizations and auctioning off of many of the U.K.'s largest state-owned companies in the 1980s despite violent strikes and opposition from the left.

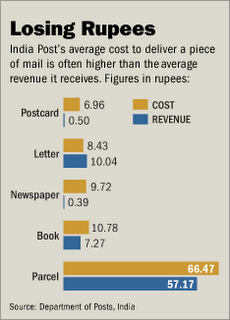

These convoluted politics explain why India Post is forced to maintain its 550,000 employees with full benefits and run a vast network of post offices, most of them unprofitable. What's more, politicians keep India Post from raising postal rates, so it loses money on almost every postcard and package it handles (see the figure above reproduced from the WSJ article).

Moving forward, India needs to figure out a clear role or exit strategy for its state owned institutions that are clearly inconsistent with its model of economic growth. Me, I am considering investing in that UPS franchise in Hyderabad.